Think the US is in decline? It's time to think again

There are multiple reasons to suggest that the US is in a state of decline as an empire. A widening wealth gap. Ongoing cultural issues including racism, violent crime, and drug addiction. Failing infrastructure. And - perhaps worst of all - partisan politics that completely gridlock effective governing.

However, for all the problems, and despite its many challengers, it could be argued that the US is more dominant in many core measures than it has ever been. More importantly, these core measures directly and significantly impact investment opportunities.

According to Alan Pullen from Magellan, “reports of US decline have been greatly exaggerated, particularly from an investment perspective”.

Pullen adds that the US has the deepest capital markets in the world, superior investor protections, and that the “global nature of many US listed multinationals means they can benefit from growth in almost any part of the world”.

“The combination of deep capital markets, high-quality global companies operating in attractive industries, and robust investor protections, has allowed the US market to deliver superior earnings growth over many years, underpinning the superior performance of the US market”.

The world of technology

One key measure of an empire’s long-term strength is how it dominates the world of technology. In the 17th to early 18th century, the Dutch established themselves as a global maritime powerhouse. The British Empire followed in the 18th century, powered by steam and electrical power. The US took over in the 19th and 20th centuries, powered by railroads, steelmaking, and oil.

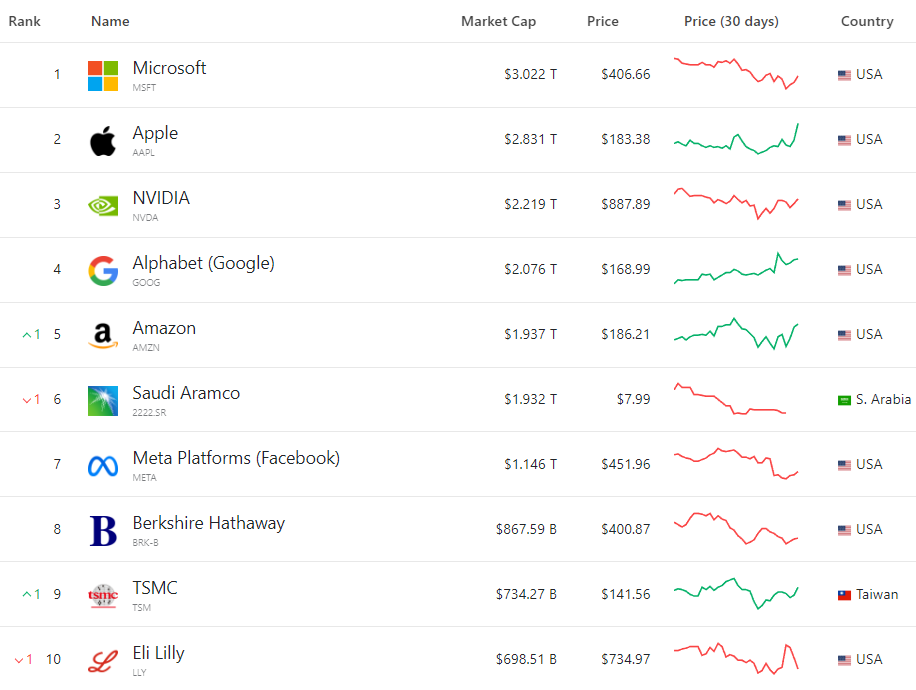

To this day, however, the US remains the dominant technological power in many realms. In the 1980’s, the only tech company anywhere near the top 10 global companies in terms of market capitalisation was IBM. The US had maybe a handful of the biggest tech companies globally.

Today? The top companies in the world by market cap are dominated by US tech companies.

The US has never been more dominant technologically across a wide range of sectors, including software, hardware, AI, quantum computing, and even nanotechnology. These sectors and themes presently provide the most exciting and rewarding investment opportunities, neatly encapsulated by the Magnificent 7.

This dominance is highlighted in the following chart, showing the 5-year performance of the S&P 500 against the Shanghai Composite – the main stock market of America’s closest rival.

It’s hard to go past the technology sector when thinking about US leadership, adds Pullen.

“The US is home to most the world’s leading technology companies, with an unparalleled innovation ecosystem.

It is the world’s largest spender on Research and Development and has developed leadership positions in important industries such as software and cloud computing infrastructure”.

Whilst technology stands out, Pullen notes that the US market also offers leadership beyond this space – particularly consumer stocks.

“The US also boasts leading companies in the Consumer sector - think of industry titans such as McDonalds (NYSE: MCD), Coca-Cola (NYSE: KO) and Nike (NYSE: NKE), the Financials sector with globally dominant payment companies like Visa (NYSE: V) and MasterCard (NYSE: MA), and Healthcare sector, amongst others", says Pullen.

Where is the US losing its advantage?

Whilst the US remains dominant in a lot of areas, it has ceded ground in some. Pullen notes that the rise of China and other emerging markets over the past three decades has resulted in a relative decline in US manufacturing.

“Lower-end manufacturing has moved offshore, including industries such as garments and footwear many years ago. Higher value manufacturing has also moved offshore to some degree - think smartphones and electric vehicles for example”, says Pullen.

And for all the tech dominance, it has not been without challenges, with Pullen adding that “the US has also been challenged in microchip manufacturing, with East Asian companies dominating leading edge manufacturing”.

“Given the strategic importance of chip manufacturing the US is looking to reinvigorate its chip manufacturing sector, with the CHIPS Act providing billions of dollars to encourage new manufacturing facilities, know as Fabs, to be developed in the US”.

Demographically vibrant

For an economy to continue to thrive, it needs a young and healthy population to be productive and to support the older generation of workers moving into retirement. Both the US and Australia can be described as demographically vibrant, due to a combination of fertility rates and immigration.

The US has a fertility rate of 1.7 births per woman. In Australia, the rate is 1.6. As a reference point, 2.1 is the required rate for population replacement (i.e. for the population to neither grow nor contract). China’s birth rate is 1.2 – and there has been much written about China’s population which is expected to shrink significantly (up to 109 million people) by 2050.

The other issue is that China's population, aged 60 and over, reached 296.97 million in 2023, or about 21.1% of its total population. Like the West, China has an ageing population that is not being replaced by new births. This problem is compounded, unlike in Australia and the US, by a lack of net migration.

According to available data, Australia had a net migration per 1000 people in 2023 of 6.4. In the US, it was 3.0. In China, the rate is -0.1.

Energy production

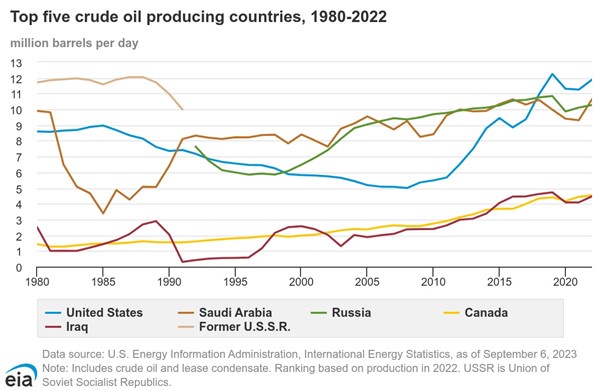

In the last 25 years, America has undergone a seismic transformation when it comes to energy production. At one point over that period, the US was the world’s biggest energy importer. As recently as 2019, the US was a net importer of oil.

The US is now the world’s biggest energy producer.

It is by far the largest producer of natural gas in the world, representing nearly a quarter of global natural gas production. Its output has increased by more than 350 billion cubic meters in the past decade owing to the increasing cost of coal, and advancements in extraction technology such as horizontal drilling and hydraulic fracturing, also known as fracking.

The US became the world’s top crude oil producer in 2018 and has maintained the lead position since. More cost-effective drilling technology helped to boost production, especially in Texas, New Mexico, North Dakota, Oklahoma, and Colorado.

Military might

In dollar terms, America spends more on its armed forces than the next ten countries combined. Although this factor has limited direct connection to investment opportunities (unless you have shares in Lockheed Martin or Raytheon, for example), it is important in a broader sense. In particular, the US’ ability to protect its interests, both locally and abroad.

Such military might mean that the US has superiority over all other countries and control of the world’s oceans via critical sea lanes, which are crucial for global trade. Furthermore, with troops stationed on every continent and a network of alliances that covers much of the industrial world, the US can exert significant and sustained economic influence and control.

Financial power

Whilst all of the above factors carry their own weight, the US’ trump card remains its financial power. The US dollar remains the global reserve currency, the US stock market is by far and away the largest and most vibrant in the world, and US debt – in the form of Treasurys – remains the lifeblood of the global financial system.

US financial hegemony remains unparalleled – and frankly, it’s not even close. According to Pullen, the US "still accounts for approximately a quarter of global GDP and is forecast to produce the strongest growth of any large economy in 2024".

America’s nearest competitor, China, had made some progress in this space, and there was even talk of the Renminbi challenging the greenback as the world's global reserve currency at one point. But a failing property market and concerns about shadow banking have scuppered that idea.

Recent events in the Middle East, rising crude oil prices, and increased uncertainty have further punctuated the dominance of the US dollar, which has surged on safe-haven buying. People only flock to one currency when things go sideways – and it’s not the RMB.

China still has significant work to do on financial reforms, the establishment of robust and transparent financial institutions, and increased market accessibility before the RMB gets anywhere near close to challenging the US Dollar and its status.

Conclusion

The US is not without its problems and some would argue it is at its weakest point, across many dimensions, in the last 50 years. But from a financial, technological and investment perspective, it remains – by some considerable margin – the best bet.

All of that said, it is important that the US – and indeed any dominant country – is tested by other countries. Challenges inspire innovation and raise the bar for everyone. From an investment perspective, new challenges also provide increased opportunities to create and grow wealth.

As for Pullen, being a globally focused manager he doesn’t mind where a company is listed, “So long as it is high quality and attractively valued, with robust investor protections”.

It just so happens that most of those companies are US-domiciled.

Pullen goes on to add, “I’ve heard it argued that US companies are relatively expensive, and while the market does trade on a higher Price to Earnings ratio than many peers, this mostly just reflects the higher-quality companies listed there, with superior cash flow generation and growth prospects.”

"We are not suggesting there no great opportunities outside the US market, there are, but our exposure to US companies reflects opportunities in global market leaders with high levels of profitability and cash flow generation, superior growth prospects underpinned by enduring tailwinds such as the shift to the cloud and AI, and reasonable valuations".

Invest In the world's best

The Magellan High Conviction Fund seeks to invest in outstanding companies at attractive prices, while exercising a deep understanding of the macroeconomic environment to manage investment risk. Click on the fund profile below, or visit the Magellan website to learn more.

2 topics

6 stocks mentioned

1 fund mentioned

1 contributor mentioned