- The Bank of Canada is widely expected to keep its target for the overnight rate at 1.75% in January as oil prices slump weighs on headline inflation and CAD trades lower.

- Oil prices fell 38% since the beginning of October until the end of 2018 weighing on headline inflation globally.

- Trade conflicts are weighing more heavily on global demand.

The Bank of Canada is widely expected to keep the target for the overnight rate unchanged at 1.75% at the beginning of 2019 as global inflation is set to remain subdued due to lower oil prices while the Bank wants to keep calm to see what are impacts of trade wars on Canada’s economy.

Inflation is “expected to ease in coming months by more than the Bank had previously forecast, due to lower gasoline prices,” the Bank wrote in the policy statement on December 5 and now it is the time to repeat the same message to justify its neutral stance.

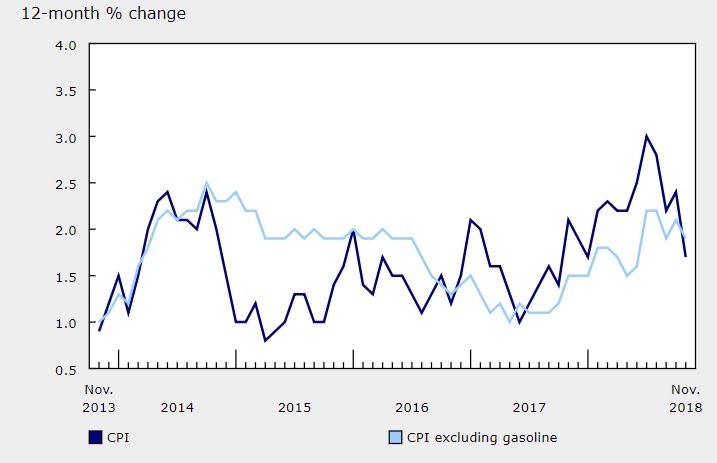

Even with the policy rates unchanged in January, the Bank of Canada Governor Stephen Poloz is expected to remain on track for further rate hike voicing the data dependent policy approach. With Canada’s inflation at 1.7% over the year in November and the Ivey PMI survey beating the market estimates on the upside in December while rising to 59.7, the Bank of Canada Governor Stephen Poloz can easily opt for a wait and see approach as major deceleration in the economic activity in Canada tracks back to September last year.

“Governing Council continues to judge that the policy interest rate will need to rise into a neutral range to achieve the inflation target. The appropriate pace of rate increases will depend on a number of factors. These include the effect of higher interest rates on consumption and housing, and global trade policy developments. The persistence of the oil price shock, the evolution of business investment, and the Bank’s assessment of the economy’s capacity will also factor importantly into our decisions about the future stance of monetary policy,” the Bank of Canada said in December policy statement while keeping the monetary policy unchanged after three rate hikes in 2018.

The Bank of Canada senior Deputy Governor Carolyn Wilkins indicated that the neutral range refers to 2.5%-3.5% range.

Along with the monetary policy statement, the Bank of Canda will release also monetary policy report and reason its neutral policy stance at the subsequent press conference at which it will try to strike a balanced tone on rates, even as the market is currently reprising the options of the US actually cutting rates in 2019 due to a sharp deceleration in the economic confidence.

Inflation in Canada

Source: Statistics Canada

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0850 after US inflation data

EUR/USD trades in positive territory above 1.0850 in the American session on Friday. The US Dollar struggles to preserve its strength following the April PCE inflation data and helps the pair hold its ground heading into the weekend.

GBP/USD retreats from 1.2765, holds on to modest gains

GBP/USD posted a two-day high peat at 1.2765 in the American session, as US data showed that the core PCE inflation held steady at 2.8% on a yearly basis in April. The pair retreated afterwards as risk aversion triggered US Dollar demand.

Gold falls towards $2,330 as the mood sours

US inflation-related data took its toll on financial markets. Wall Street turned south after the opening and without signs of easing price pressures in the world’s largest economy. The US Dollar takes the lead in a risk-averse environment.

Here’s why Chainlink price could crash 15% despite spike in social volume Premium

Chainlink price has flashed multiple sell signals after its recent climb, hinting at a short-term correction. This signal comes despite a double-digit growth in its social volume. LINK bulls need to exercise caution as this forecast is backed by on-chain metrics.

Week ahead – ECB rate cut might get eclipsed by BoC surprise and NFP report

ECB set to slash rates on Thursday, focus on forward guidance. But will the BoC take the lead when it meets on Wednesday? US jobs report eyed on Friday as Fed unyielding on cuts. OPEC+ might extend some output reductions into 2025.