I would like to give credit to both of Bob Volman's books which are simply the best in the market when it comes to learning about scalping and I have not found a thread dedicated to his 2nd book (lUnderstanding price action) so I thought to start one.

Here are my notes that I took from the book, I have listed the main points that will help in giving you the backbone to form a strategy centered around the book.

PRICE ACTION THEORIES - This gives an understanding of the key elements in price movements

Here are my notes that I took from the book, I have listed the main points that will help in giving you the backbone to form a strategy centered around the book.

PRICE ACTION THEORIES - This gives an understanding of the key elements in price movements

- DOUBLE PRESSURE - Compressed tension of price occurring before a breakout occurs in one direction

- SUPPORT AND RESISTANCE (S&R) LINES - Curical zones of a technical test where we can expect price to stall

- CEILING TEST - Think of this as a minor S&R line forming near a technical test

- FALSE BREAKS - As the name suggests these breaks may or may not occur; we need to be aware that a break may be false, a good way of assessing the quality of a break as described in the book is to wait for price to pass above the initial break signal bar

- PULLBACK REVERSALS - into the 40-60% region; this will provide a good risk to reward ratio the further you allow the pullback to go

- ROUND NUMBER EFFECT - Applying guidelines on your chart in the increments of 50 pips will allow you to easily see the pulling power these lines have on the price and to use them to your advantage

MORE GENERAL NOTES

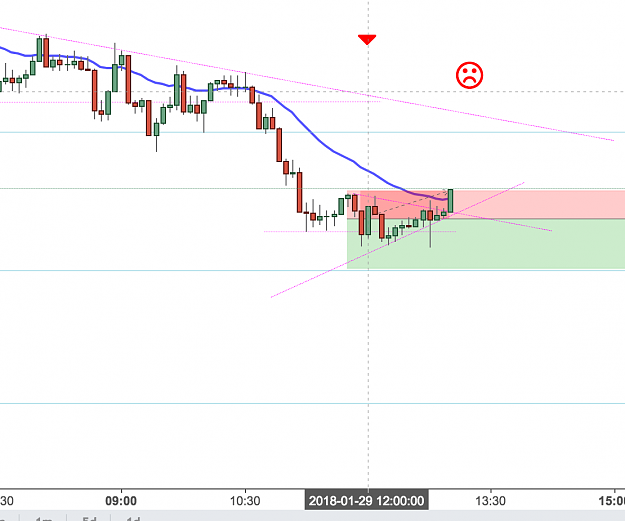

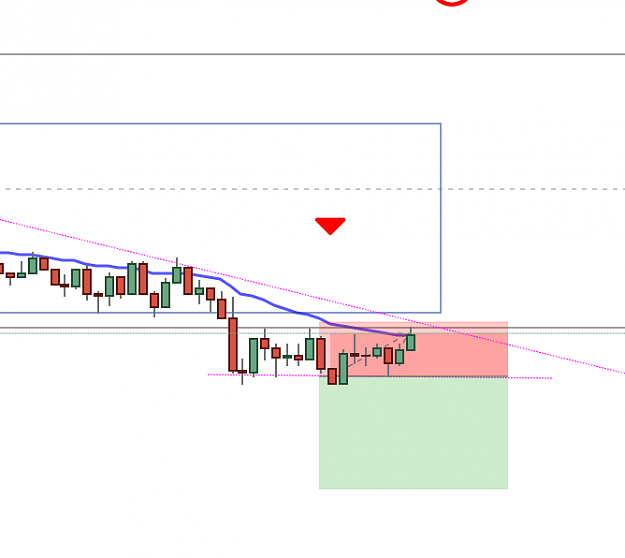

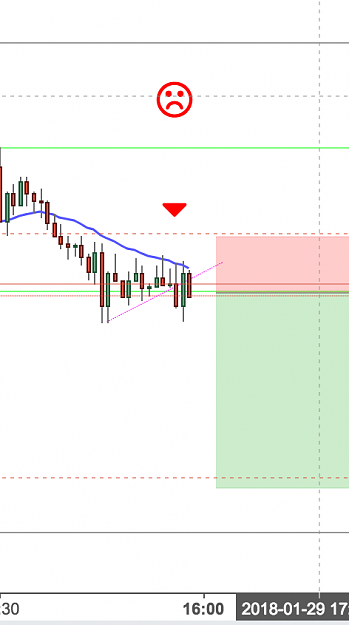

- The setup is a 25ema (close) on a 5 min chart with a TP 20 and SL 10 (examples mostly used the EURUSD but principles can be applied to other charts)

- Watch out for double tops, triple tops, head and shoulders, inside bars, flags which can give an indication to what price will do next

- Try and execute orders close to the 25ema (aka the perfect filter in the book) and preferably wait for a squeeze and then a breakout to occur before confirming a bias

- Be wary of the possibility that whilst in a trade, it may fail due to upcoming resistance/support/technical test/round-number/reversal candlestick etc and it may be wise to exit in strength and just observe what price is going to do next and then think about re-entering (or wait for another next set-up)

- Keep away from news unless you know how to trade it

- Maintian a minimum of 1:1 risk to reward ratio

LIST OF THE MOVES

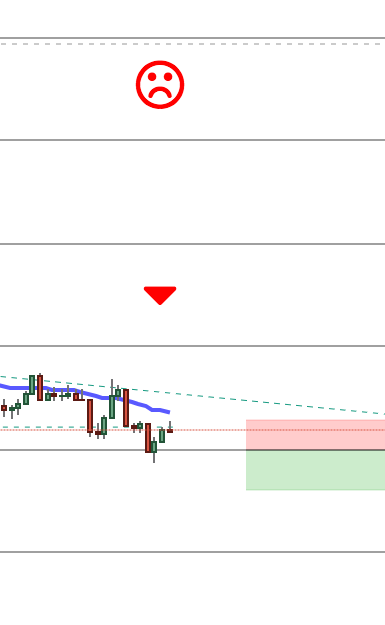

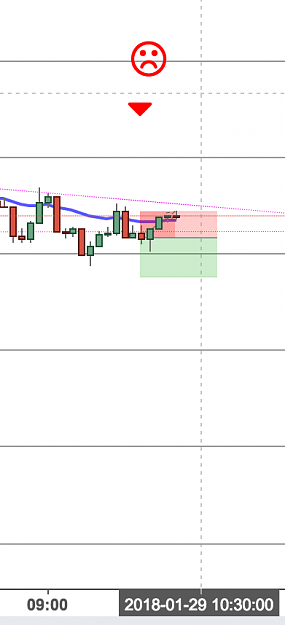

- PATTERN BREAK - Consists of a build up then a break out (the breakout is the signal to take the trade)

- PATTERN BREAK COMBI - A strong bullish/bearish candlestick (i.e. 'Powerbar') next to an inside bar that closes near the direction of the Powerbar (the inside bar is the signal to take the trade, or you can wait until price passes the Powerbar)

- PULL-BACK REVERSAL - Ideally we want three conditions met: correction at the 40-60%, testing the 25ema and also testing any previous S&R lines. Once these have been met we can either take the trade straight away or wait for confirmation

To Pipccess and Beyond