I've decided to write a journal here for several reasons

- Accountability - By publicly posting my trades I hope to be more accountable and disciplined in following my strategy.

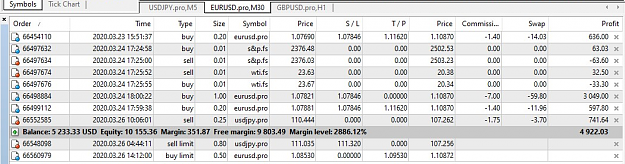

- Transparency - This will serve as part of my "track record". This will also help hold my brokers accountable in case they pull a fast one on me.

- Help - To inspire other traders of what is possible and to help me realize what I don't yet know (e.g. issues with brokers and leverage exceeding 1000 lot orders) and support to help me keep a level head.

The Goal

It's actually $1,000,000 in about a year coming from $5,000 but I know it will seem so incredulous to others so I'll bring it down a notch. My backtest tells me it can be done with last year's low volatility. I'm expecting this to be even more reachable with this year's expected high volatility.

Strategy

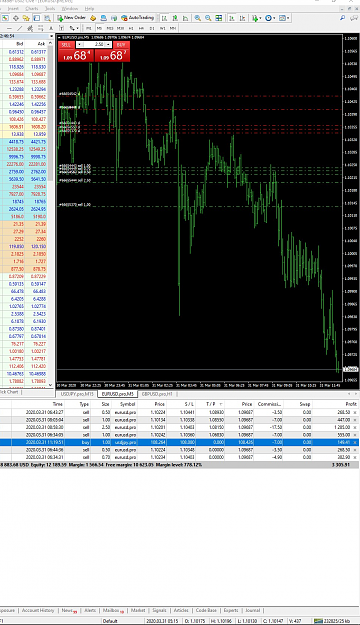

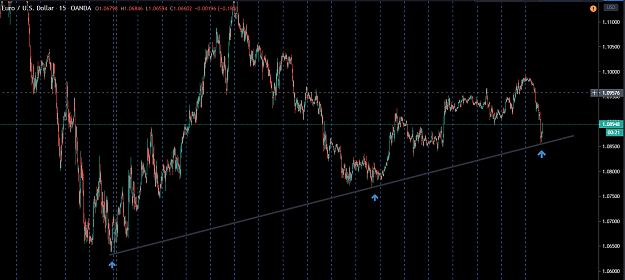

This is a trend / momentum / breakout strategy that swings from about 1 to 5 days. Using my understanding of price action, fundamental catalysts, with moving averages to read the charts in context. I do not use any other indicators. Frequency is around 3 round trip trades a month. Maximum of 2 entries a day. I may scale in / out of my core position but will try my best to get my entries very close together. For this trend strategy, entries are easy and exits are harder. I will strive to optimize my exits. (I will not disclose the specifics of my strategy).

Money Management

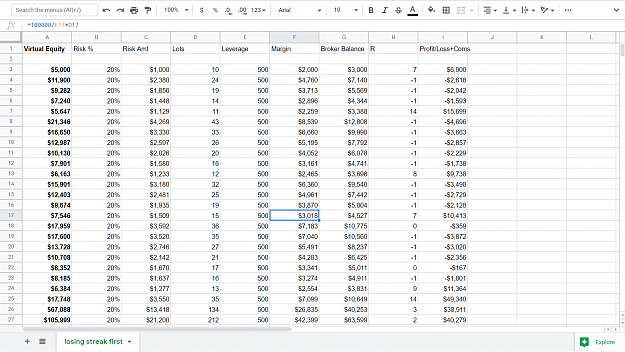

I will start with $5,000 equity and risk 20% equity each trade. If the first trade is down or equity falls back to $5,000 or below, I will top it up and $1,000 will be the minimum trade. Once I reach $100,000, I will withdraw and reset back to $5,000 equity on my way to $1,000,000. I would shoot for around 7R to 14R trades on average. Risking at minimum $1,000 each core position.

A sample of what my money management may look like. Yes, wild swings! Help keep me sane!

Psychology

$ values affects us differently. I know I can risk $100,000 for this business but losing $1,000 in a matter of minutes gets to me. Opening a $100,000 brick and mortar business is as much a gamble, but losing $1,000 that quickly while doing nothing most of the time waiting for the proper setup is something different for the mind. I hope to overcome this hurdle and be constantly reminded with your help.

Brokers

I will be using any one or a combination of these brokers at any given time: Interactive Brokers, IC Markets, Pepperstone, AXI Trader, Oanda.

My Background

I've dabbled trading in the stock market (Philippines and U.S.) since the year 2000. Day traded U.S. equities for a year from 2007 to 2008. I was a programmer by profession. I've been trading FX since 2017 but only committed all my time and effort into it last October 2019. The knowledge and experience I gained the past 6 months exceeded what I've learned during all those early years and I believe has set me up to finally reach my goals.

Thread Rules

- Feel free to chip in but treat everyone with respect.

May the markets be in our favor!