First and Foremost I must thankyou PeterCrowns for being such an inspiration, he opened my eyes with his words, I took some of his hints and had some yet to figure out, feel free to share if you know what he is talking about. Other honorable mentions: Bemac (for starting the thread) and TheRealThing (PC's mentor).

This Thread's Main Purpose:

1. To analyze his posts and try to understand it, catch his "hints".

2. Trade the DIBS method live.

Who Is This Thread For?

1. System jumpers.

2. Seasoned DIBS traders.

Quick review of PeterCrowns' DIBS system:

1. Entry= H1 Inside Bar(IB).

//SL is below/above the IB, Pending STOP Orders are placed above/below the IB too.

2. Exit = D1 SMA(close, 20).

//It either hits your SL or it hits your trail SL. Not so fun (trading profitably) isit? The holy grail of this system is in the LONG TAILS.

edit: sorry I forgot to mention, that he takes 50% off on 1:1, and let the rest run until it's stopped by his trailing stop or he closed it manually when he is on holiday.

3. Trend Filter=

a.) Today's D1 Open Price relative to H1 IB.

//if IB is below Today's open= Only look for Sell Stops, vice versa. However if IB is between Today's open, trade both ways.

b.) D1 Open Price starts from 06:00 GMT.

//he trades from 06:00 GMT to 15:00 GMT or 16:00 GMT max.

c.) HOT HAND (THIS IS CRUCIAL)

//I'm just gonna quote him (link)

QuoteDislikedTrading the "hot hand": Trading the strongest/weakest market is actually really simple. For example, yesterday the Eur/Usd was up more proportionately than the Usd/Chf was down. This was because the Usd/Chf wasn't even a down day. Definitely off its highs but not down relative to last week's close. The Eur/Usd was up, up and away! So that is the market you buy.

//quick note: in general, he only trades 4 pairs= EURUSD, GBPUSD, USDCHF, USDJPY.

//"Hot Hand" Summary:

/*

Most trending day relative to Yesterday's close and last Week's Close. //I love this, it's so objective..

So in short,

Yester-day's close is up (bullish), and Price Now is above last Week's close = CLEAR UP TREND = HOT HAND.

Yester-day's close is up (bullish), and Price Now is below last Week's close = Indecision = BAD HAND.

Yester-day's close is down (bearish), and Price Now is above last Week's close = BAD HAND.

Yester-day's close is down (bearish), and Price Now is below last Week's close = HOT HAND.

unpopular opinion: I think Hot Hand is a poker terminology.

*/

QuoteDislikedObviously, it would logically follow that the currencies which are up more are better buys and the ones down more are the better shorts. So basically, if you get a buy setup forming on two strong currencies, take the trade on the one up most on the day.

//I do think this one should be self-explanatory.

//For e.g. GU is up, UJ is down and both are Hot Hands, then you should pick the ULTIMATE HOT HAND.

//you should pick which ever is the more trending one.

//and if all are Indecision(daily up, Weekly down) then simply don't trade.

//DIBS is merely a Trend Following strategy and trading IBs is a method to get sniper entries and tight stops on an existing trend.

//the holy grail is in the LONG TAILS.

To Summarize:

Lemme quote him before I give you my humble opinion (link) //yup, still the same post.

QuoteDislikedI'm sure this sounds simplistic to everyone, and maybe this stuff is obvious to you all, but I doubt it. How many times do you find yourself buying a weaker currency instead of the stronger one, thinking that the weaker one "has" to catch up, or the stronger one has already moved as much as it is likely to already.

Always buy setups in the strongest daily markets, always take sell orders in the weakest daily markets.

And yes, I have come up with very simple methods to exploit this. Breakouts of inside bars on hourly charts is one very useable technique I use a lot. Pennants of various constructions work very well too. Once you know which markets to trade, and in which directions--- it is a pretty simple job.

After all, trading is just risk control. Unfortunately it can take a while for us to learn to use the simple tools we have available.

Okay so my opinion:

This is how he basically trade in general:

1. TRADE TRENDING MARKETS.

2. FIND ENTRIES ON SMALLER TIMEFRAME.

3. KEEP YOU BETS SMALL.

sounds familiar? If you don't like this simplistic idea, I suggest you to jump to other strategies and come back here when you have tried everything. Cuz I assure you, I've tried everything, and the simpler & more objective it is, the longer it will work, this is called consistency.

//I suggest you to click the link on the word "consistency" blue-labeled and read it.

FOR THE SAKE OF CLARITY:

Inside Bar is not THE system you want to focus your attention to. THE system that you want to focus to is THE HOT HAND method.

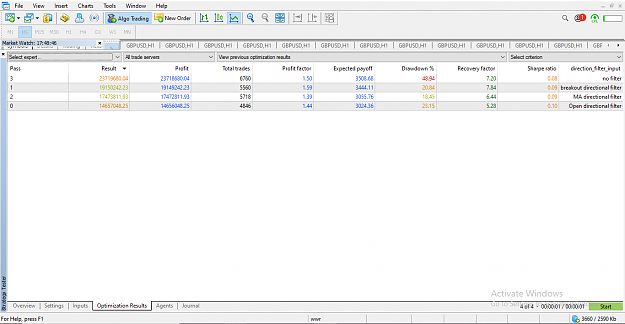

NB: Inside Bars has NO EDGE, I've personally built an EA and back-tested over 10 years worth of data. I'll geek-out about the research on the 2nd post.

Inside Bar, like any other Candle Stick patterns has NO EDGE what-so-ever, they are simply tools for me.

F.A.Q. on my statement above

1.) So why do they work?

>> THEY ONLY SOMETIMES WORK. WHICH PROVES NO EDGE.

2.) So why are there profitable traders who are still using it?

>> I can't give you one correct answer but I can give you a general answer: Sniper Entries, Tight SL, low risk entries (low risk means tight SL).

>> alternate answer: I can't put it better than Mark Cuban himself:

QuoteDisliked... everyone is a genius on a bull market...

//any type of trader will simply profit from a bull/bear market if they follow it. even the Gann's will also profit from it.

//even if you just place a buy/sell stop on the high/low of yesterday, everyday. You will could be a millionaire. I can guarantee that. (with high risk ofc)

3.) If they prove no edge at all, so how do I trade the market to make infinite yield (infinite return)?

>> By following the trend and keep your Stop Losses relatively tight, and because now you will lose more than you win you should consider on keeping your bets small. (no more than 1% per trade)

GLOSSARY:

LONG TAILS= let your winners run and cut your losses short.

//"Cut your losses short" translates into= having a tight stop-loss.

//for some of you who still don't get it, it literally means holding a trade for a prolonged period of time, to get the most profits out of the existing trend, and simply hold your position until you get stopped out by your trailing stop loss. Or I would like to call it: Buy n Hold.

HOT HAND= a pair with a STRONG TREND.

//Whose current Price is the furthest away from last Week's Close is the Ultimate HOT HAND.