For those who really want to build a long and sustainable career in Forex Trading, this stuff is real, proven and free. Itís my commentary on what has become a long and successful career in this business.

First of all never use an EA. They do not work. Ever. And for anyone out there who says ďnonsense, mine doesĒ my response is, ďso why are you reading this?Ē EAs donít work in the real world. They just donít. Period. No comment, no reply, they do not work. No exceptions. If you are so deluded that you think you can make a fortune in your sleep while some robot does all the work, regardless of trading conditions and market manipulations you are a complete moron and you need to get a job because this business is not for you. If you donít know about broker algorithms that detect and respond to EA activity you are naÔve and you will be eaten alive.

Trading is very, very simple. It kills me when people show me their charts and it looks like an explosion in a paint factory. Stop it with all this BS. Heiken Ashi, Renko, Ichimoku, is it all working for you in real time with real money? REALLY?

When impatient people canít handle the reality of the market they start to look for ways to improve things but all they do is confuse matters. Suddenly if there arenít 10 different confirming and supporting elements, thereís no trade, and then when all of these factors do finally align, suddenly a news release or the comments of a Central Bank Official sends the market the wrong way and the SL is hit.

ďIf this crosses this, and itís within that, and the X symbol flashes green but the dots havenít gone purple yet, and then the gsixcet4mz* indicator crosses down through a line and the candle closes but that candle is higher than the last candle then if the Fibo says this and the Gartley says that but itís under a pivot and itís Tuesday and the sun is shining, then itís a SELLĒ. If this is how you trade, do yourself a favour and stop. Right now, just stop.

Trading is very very simple, but people are very very impatient.

Traders have to understand and fully commit to accepting, that there will always be losing trades. Take them on board, accept that they are part of the game, make your next trade and see where it goes, draw a line under the loser, it wasnít meant to be, the market didnít follow through, thatís all it is. Too many people hit 3 losers in a row and move on to the next Holy Grail. NO! Trading is about results over time, itís about 3 steps forward and 1 step back, sometimes 2, sometimes 3 steps back before a resumption to the upside. Donít be afraid of it. Maintain confidence, especially if the strategy has previously proven to be productive. NEVER move a stoploss further away!

Impatient traders become successful traders when they become patient traders.

Patient traders make far more regular, consistent money that yahoos and scalpers who want to smash it out the park. I recently helped a guy who is now on course to reach $700,000 at the end of his third year and his starting balance? $1000. He still wonít be ordering the Lamborghini because he knows where heíll be if he trades another 12 months (scary)

ďSo OK then Mr patient trader how do we do the same?Ē

Well Iím going to disappoint everyone because itís staring you all in the face and deep down you already know it. Thereís no holy grail system because no such thing exists, although what Iíll present to you is as close as anything else ever gets

If you get excited by 20-somethings buying Lamboís after trading from their phones for a few days/weeks, letís not insult each otherís intelligence, this really ainít for you. Maybe bookmark this and come back in 10 years when youíve tried every scam and scheme out there to make you a bajillionaire overnight. Good luck. For the rest of us:

1. Follow this for 3 months before you arrive at a conclusion

2. Donít deviate from what the rules say

3. Always analyse a losing trade and ask yourself what went wrong (I guarantee 90% of the time if youíre honest with yourself itís usually something you did or didnít do, not the strategy itself)

To begin with you need to expand your horizons and timeframes

The first foundation stone of this strategy is that you must promise yourself you will do this:

For this first part of the strategy you will only take trades from a H4 alert if the alert also coincides with the direction of the Daily. So if the Daily is Long, you only take H4 Longs. The number of times this will get you into a big trade time after time on a trending pair is ridiculous. SL is always a little way above/below the last swing point (very rarely get taken) and TP is up to you. Personally I split the trade in half, one half is taken at 45-70 pips and the other one runs until an opposing signal (gave me 220 pips on a recent AUDCAD)

So the core strategy is trading H4 in line with Daily direction.

Before we talk about H1, let me add a bit more detail. First of all, when you get an H4 alert, just check the price action relative to the indicator. If itís ďgoneĒ then just be patient and wait for the price to revisit the indicator line or sometimes in a very strong move right at the close of a candle the line and new candle can be close enough to jump on. This is a key reason why EAís fail. They are robotic and they just trade when conditions are met. A manual trader shifts the balance in his/her favour buy waiting for the optimum entry point.

Also it is extremely important to recognise this: An H4 trade can take 1 candle or several days to come good, so always watch the data calendar. Donít take a new Dollar trade the day before the NFP release etc

You must also take into account major previous levels of supply and demand, double tops, marketmaker patterns, trend lines, fibo levels etc. No system is entirely mechanical and again this is why EAs fail. YOU are the trader in this scenario and YOU will see when itís right to get into a trade or when to avoid it.

Sometimes the best trade is not to trade at all

Yes I get it, you can always talk yourself out of a trade and unless you trade how can you make money? Well the best way to trade is to ensure the trade is right, and then commit to it.

So we are going to trade the H4 in line with the Daily and subject to basic TA principles while taking the fundamental picture also into mind.

So for the less patient guys what about this strategy on H1?

Yes itís fair enough to trade this on H1 too, but itís a bit noisy on H1 sometimes. First of all if you are going to trade this on H1, only go in the direction of the H4 and IDEALLY only when H4 and Daily align. 30 pips should be good on each trade here.

Personally this is how I use the H1. If I have a H4 long trade and itís going against me, if the H1 goes short Iíll take it, but then if/when the market comes back in my favour as shown by the indicator, Iíll ditch the H1 and let the price action bring me home. It hedges the downside risk on the underlying H4

You can trade M15 in direction of H4 and the M5 in direction of H1 too

BUT to be clear I personally only ever trade the H4 charts in direction of Daily, with an occasional H1 Hedge as required.

The key is to only trade with the Daily direction and not to trade just because you see an arrow, you take it because the general picture supports it and, AFTER the arrow the price returns to a more favourable entry point.

Also trade 1% to 1.5% risk so on a $100k demo maybe a 2 lot trade with 75 pip SL (common on H4) or 2 x 1 lot trades, one TPs at 50-ish and the other runs to a reversal signal

OK so whatís the indicator? Well this could be anything from a 9 period MA alone, maybe a 9 crossing a 20, or my preferred indicator the much maligned HalfTrend

Trading the HalfTrend indicator on H4 aligned with Daily will always keep you on the right side of the market. Donít take a signal if recent action has been sideways, to avoid getting whipsawed, look for trend reversals and trend continuations rather than breakout scenarios. This strategy waits for breakouts to re-test the breakout level at which point it invites you back in to resume the trend. Perfect.

In essence then, no news here, no rocket science, no brain surgery. Iím preaching correct trading principles rather than some super holy grail strategy.

Check Calendar, check Daily, check levels, trend lines and fibos, and if itís all OK take the trade, enter SL but then be patient! Wait for it to all pan out and more often that not you will hit a winner with the occasional home run. The half trend indicator is an ideal close-out tool too, so if you are short on a pair but the candle closes above the downpointing red line, get out and either resume when appropriate or wait for the next one.

Guys, trading is easy. Iím running 83% winning trades which means 17 trades in every 100 will hit SL. If I only average 1:1 (I donít itís much higher) for every $8300 I win, I will lose $1700. I can live with that!

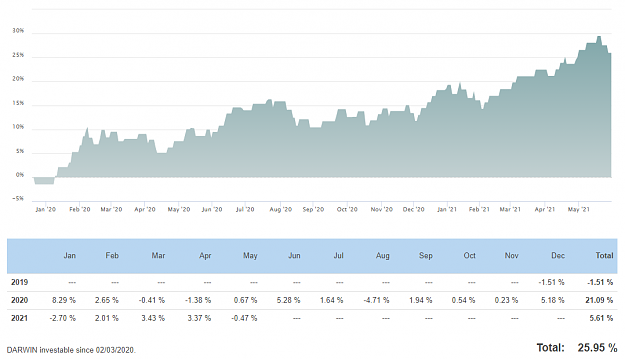

This is a 20% per month strategy guys but only if you have the balls to relax and take your time. Donít chase trades, let them come to you. Take the low hanging fruit. Avoid UK/US/Whole Europe Holidays.

Thatís it Ė you make money from these markets by buying when it goes up and selling when it comes down. The most simple, basic approach to trading is the one which will deliver the longer term results. 20% per month is possible. Compound that over 3 years from a $10 start and enjoy your $7m.

A million strategies but Iím making money trading the most basic of all. Makes you think right?.

First of all never use an EA. They do not work. Ever. And for anyone out there who says ďnonsense, mine doesĒ my response is, ďso why are you reading this?Ē EAs donít work in the real world. They just donít. Period. No comment, no reply, they do not work. No exceptions. If you are so deluded that you think you can make a fortune in your sleep while some robot does all the work, regardless of trading conditions and market manipulations you are a complete moron and you need to get a job because this business is not for you. If you donít know about broker algorithms that detect and respond to EA activity you are naÔve and you will be eaten alive.

Trading is very, very simple. It kills me when people show me their charts and it looks like an explosion in a paint factory. Stop it with all this BS. Heiken Ashi, Renko, Ichimoku, is it all working for you in real time with real money? REALLY?

When impatient people canít handle the reality of the market they start to look for ways to improve things but all they do is confuse matters. Suddenly if there arenít 10 different confirming and supporting elements, thereís no trade, and then when all of these factors do finally align, suddenly a news release or the comments of a Central Bank Official sends the market the wrong way and the SL is hit.

ďIf this crosses this, and itís within that, and the X symbol flashes green but the dots havenít gone purple yet, and then the gsixcet4mz* indicator crosses down through a line and the candle closes but that candle is higher than the last candle then if the Fibo says this and the Gartley says that but itís under a pivot and itís Tuesday and the sun is shining, then itís a SELLĒ. If this is how you trade, do yourself a favour and stop. Right now, just stop.

Trading is very very simple, but people are very very impatient.

Traders have to understand and fully commit to accepting, that there will always be losing trades. Take them on board, accept that they are part of the game, make your next trade and see where it goes, draw a line under the loser, it wasnít meant to be, the market didnít follow through, thatís all it is. Too many people hit 3 losers in a row and move on to the next Holy Grail. NO! Trading is about results over time, itís about 3 steps forward and 1 step back, sometimes 2, sometimes 3 steps back before a resumption to the upside. Donít be afraid of it. Maintain confidence, especially if the strategy has previously proven to be productive. NEVER move a stoploss further away!

Impatient traders become successful traders when they become patient traders.

Patient traders make far more regular, consistent money that yahoos and scalpers who want to smash it out the park. I recently helped a guy who is now on course to reach $700,000 at the end of his third year and his starting balance? $1000. He still wonít be ordering the Lamborghini because he knows where heíll be if he trades another 12 months (scary)

ďSo OK then Mr patient trader how do we do the same?Ē

Well Iím going to disappoint everyone because itís staring you all in the face and deep down you already know it. Thereís no holy grail system because no such thing exists, although what Iíll present to you is as close as anything else ever gets

If you get excited by 20-somethings buying Lamboís after trading from their phones for a few days/weeks, letís not insult each otherís intelligence, this really ainít for you. Maybe bookmark this and come back in 10 years when youíve tried every scam and scheme out there to make you a bajillionaire overnight. Good luck. For the rest of us:

1. Follow this for 3 months before you arrive at a conclusion

2. Donít deviate from what the rules say

3. Always analyse a losing trade and ask yourself what went wrong (I guarantee 90% of the time if youíre honest with yourself itís usually something you did or didnít do, not the strategy itself)

To begin with you need to expand your horizons and timeframes

The first foundation stone of this strategy is that you must promise yourself you will do this:

For this first part of the strategy you will only take trades from a H4 alert if the alert also coincides with the direction of the Daily. So if the Daily is Long, you only take H4 Longs. The number of times this will get you into a big trade time after time on a trending pair is ridiculous. SL is always a little way above/below the last swing point (very rarely get taken) and TP is up to you. Personally I split the trade in half, one half is taken at 45-70 pips and the other one runs until an opposing signal (gave me 220 pips on a recent AUDCAD)

So the core strategy is trading H4 in line with Daily direction.

Before we talk about H1, let me add a bit more detail. First of all, when you get an H4 alert, just check the price action relative to the indicator. If itís ďgoneĒ then just be patient and wait for the price to revisit the indicator line or sometimes in a very strong move right at the close of a candle the line and new candle can be close enough to jump on. This is a key reason why EAís fail. They are robotic and they just trade when conditions are met. A manual trader shifts the balance in his/her favour buy waiting for the optimum entry point.

Also it is extremely important to recognise this: An H4 trade can take 1 candle or several days to come good, so always watch the data calendar. Donít take a new Dollar trade the day before the NFP release etc

You must also take into account major previous levels of supply and demand, double tops, marketmaker patterns, trend lines, fibo levels etc. No system is entirely mechanical and again this is why EAs fail. YOU are the trader in this scenario and YOU will see when itís right to get into a trade or when to avoid it.

Sometimes the best trade is not to trade at all

Yes I get it, you can always talk yourself out of a trade and unless you trade how can you make money? Well the best way to trade is to ensure the trade is right, and then commit to it.

So we are going to trade the H4 in line with the Daily and subject to basic TA principles while taking the fundamental picture also into mind.

So for the less patient guys what about this strategy on H1?

Yes itís fair enough to trade this on H1 too, but itís a bit noisy on H1 sometimes. First of all if you are going to trade this on H1, only go in the direction of the H4 and IDEALLY only when H4 and Daily align. 30 pips should be good on each trade here.

Personally this is how I use the H1. If I have a H4 long trade and itís going against me, if the H1 goes short Iíll take it, but then if/when the market comes back in my favour as shown by the indicator, Iíll ditch the H1 and let the price action bring me home. It hedges the downside risk on the underlying H4

You can trade M15 in direction of H4 and the M5 in direction of H1 too

BUT to be clear I personally only ever trade the H4 charts in direction of Daily, with an occasional H1 Hedge as required.

The key is to only trade with the Daily direction and not to trade just because you see an arrow, you take it because the general picture supports it and, AFTER the arrow the price returns to a more favourable entry point.

Also trade 1% to 1.5% risk so on a $100k demo maybe a 2 lot trade with 75 pip SL (common on H4) or 2 x 1 lot trades, one TPs at 50-ish and the other runs to a reversal signal

OK so whatís the indicator? Well this could be anything from a 9 period MA alone, maybe a 9 crossing a 20, or my preferred indicator the much maligned HalfTrend

Trading the HalfTrend indicator on H4 aligned with Daily will always keep you on the right side of the market. Donít take a signal if recent action has been sideways, to avoid getting whipsawed, look for trend reversals and trend continuations rather than breakout scenarios. This strategy waits for breakouts to re-test the breakout level at which point it invites you back in to resume the trend. Perfect.

In essence then, no news here, no rocket science, no brain surgery. Iím preaching correct trading principles rather than some super holy grail strategy.

Check Calendar, check Daily, check levels, trend lines and fibos, and if itís all OK take the trade, enter SL but then be patient! Wait for it to all pan out and more often that not you will hit a winner with the occasional home run. The half trend indicator is an ideal close-out tool too, so if you are short on a pair but the candle closes above the downpointing red line, get out and either resume when appropriate or wait for the next one.

Guys, trading is easy. Iím running 83% winning trades which means 17 trades in every 100 will hit SL. If I only average 1:1 (I donít itís much higher) for every $8300 I win, I will lose $1700. I can live with that!

This is a 20% per month strategy guys but only if you have the balls to relax and take your time. Donít chase trades, let them come to you. Take the low hanging fruit. Avoid UK/US/Whole Europe Holidays.

Thatís it Ė you make money from these markets by buying when it goes up and selling when it comes down. The most simple, basic approach to trading is the one which will deliver the longer term results. 20% per month is possible. Compound that over 3 years from a $10 start and enjoy your $7m.

A million strategies but Iím making money trading the most basic of all. Makes you think right?.