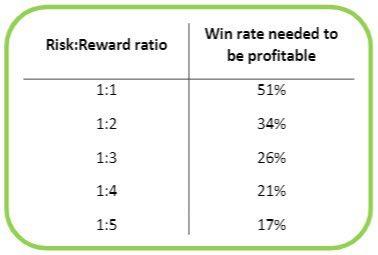

It is a matter of math. The higher your reward with respect to your risk; the less winrate you need.

This was the hardest for me to change in how I traded; where i had to let myself lose a couple of times and bring in the bagger, the winning trade.

The elements of course is your have a system where you stick to the first 100% as capital as basis. And you must in this sense be able to trade atleast 20 to 25 x over the course of the month.

If you're like me who make money outside of trading and use trading as card counting like in the casinos; then you'll be satisfied if you win and get off the table when you do.

So the idea is risk to reward should atleast be 1 is to 3. Where you allow yourself 6 wins every 15 trades to be profitable or 40% winrate.

For me the idea is simply doing the reversals and the fibonacci. But if you're not into fibs, you can use your own entry and exit model.

Summary

1. Risk is atleast 1/3rd of the reward or reward is x3 the risk.

2. Risk is at most 5% of the 100% capital. And you then don't adjust the 100% until 20 to 25 trades or 1 month has passed.

3. Use fibonacci retracement tool for consistency in your entries. Else, levels or candle patterns is viable.

4. Have a trusted 40% winrate system that you have faith in.

This was the hardest for me to change in how I traded; where i had to let myself lose a couple of times and bring in the bagger, the winning trade.

The elements of course is your have a system where you stick to the first 100% as capital as basis. And you must in this sense be able to trade atleast 20 to 25 x over the course of the month.

If you're like me who make money outside of trading and use trading as card counting like in the casinos; then you'll be satisfied if you win and get off the table when you do.

So the idea is risk to reward should atleast be 1 is to 3. Where you allow yourself 6 wins every 15 trades to be profitable or 40% winrate.

For me the idea is simply doing the reversals and the fibonacci. But if you're not into fibs, you can use your own entry and exit model.

Summary

1. Risk is atleast 1/3rd of the reward or reward is x3 the risk.

2. Risk is at most 5% of the 100% capital. And you then don't adjust the 100% until 20 to 25 trades or 1 month has passed.

3. Use fibonacci retracement tool for consistency in your entries. Else, levels or candle patterns is viable.

4. Have a trusted 40% winrate system that you have faith in.

Trading is gambling. So gamble responsibly.