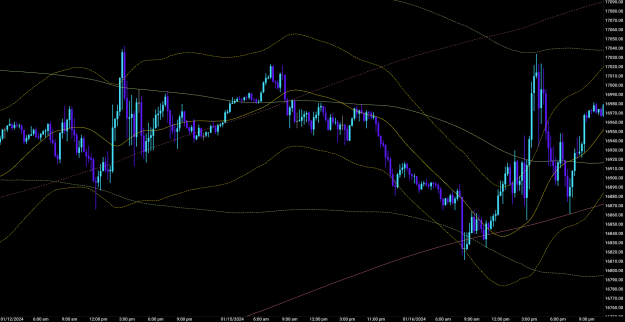

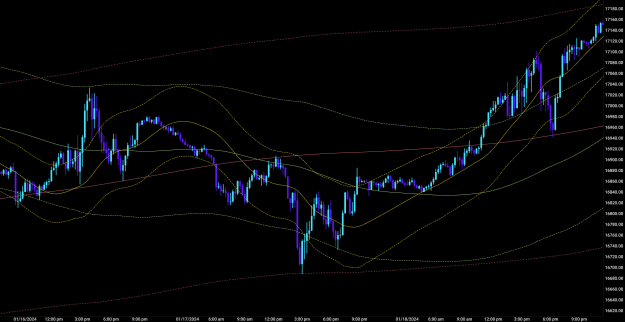

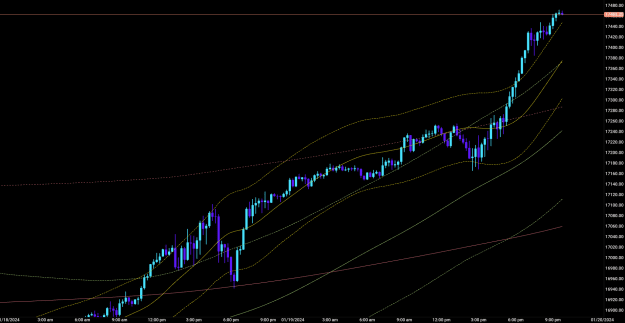

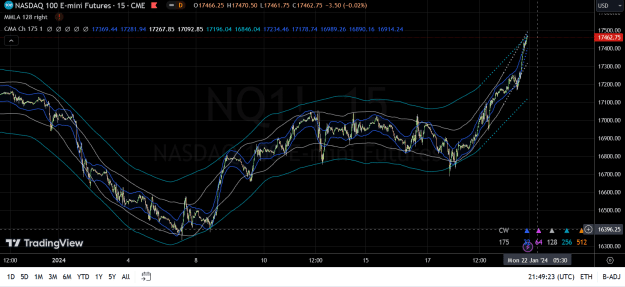

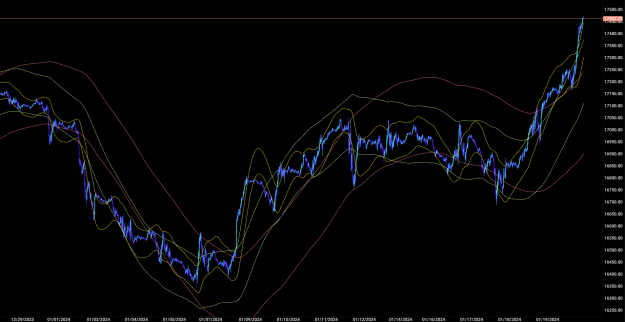

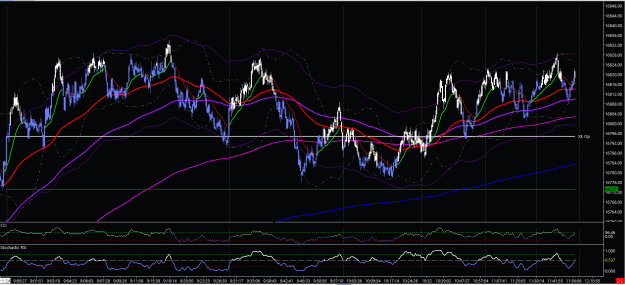

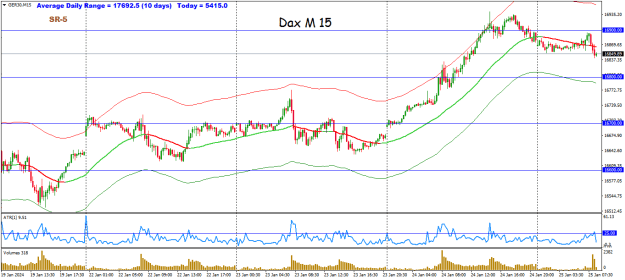

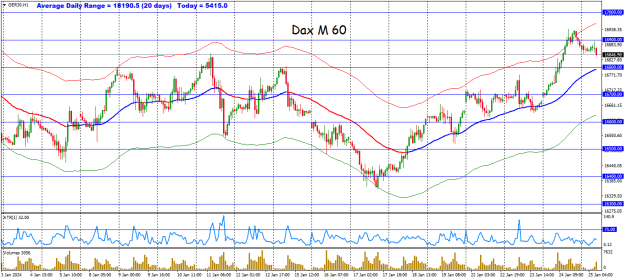

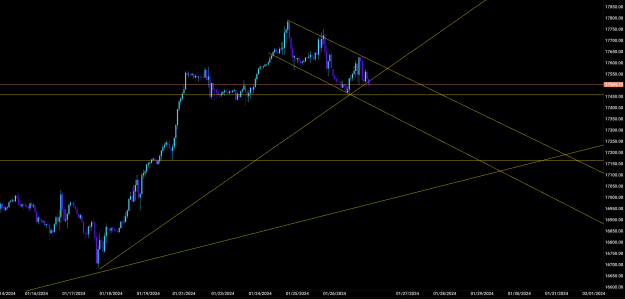

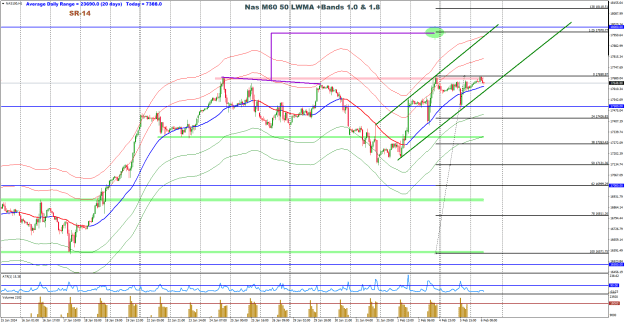

A multi-scale review of the week in three overlapping pictures.

What a week it was, and I am happy with my catch for the week, but I also felt that I was too focused on the scalping perspective when big moves were underway. For the purpose of improving my longer-term view I decided to review and refresh a multi-scale model that I used to use daily. Multi-scale models are frequently used for financial forecasting (see e.g. https://link.springer.com/chapter/10...540-48061-7_66). You may be familiar with similar approaches from parisboy's thread Analysis and Trading based on Envelopes, Waves, Cycles.

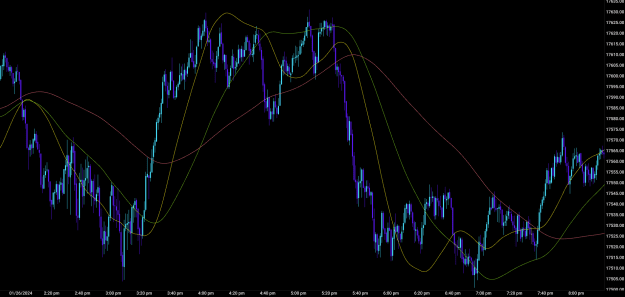

The charts below are my attempt at a simple model for use in trading NQ. It's based on Hull Moving Average Keltner channels. Why HMA? Because it's a linear predictor of the WMA of half its period length.

Happy to share details should anyone be interested. These are 15m charts.

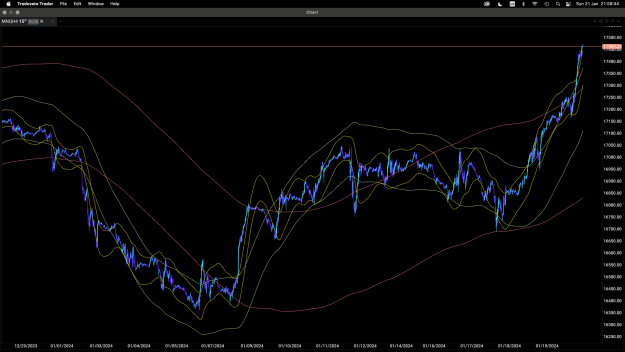

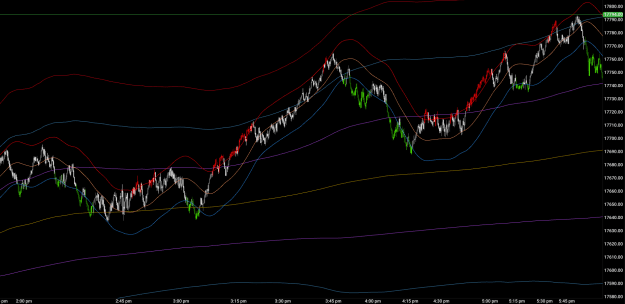

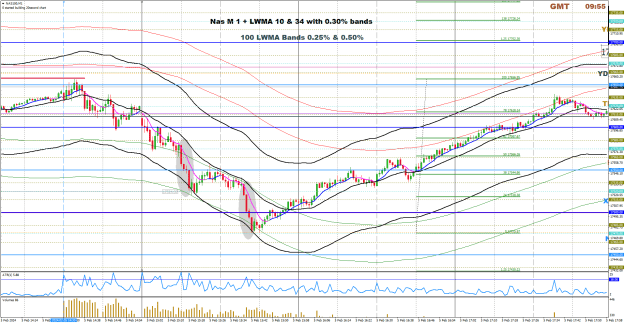

What a week it was, and I am happy with my catch for the week, but I also felt that I was too focused on the scalping perspective when big moves were underway. For the purpose of improving my longer-term view I decided to review and refresh a multi-scale model that I used to use daily. Multi-scale models are frequently used for financial forecasting (see e.g. https://link.springer.com/chapter/10...540-48061-7_66). You may be familiar with similar approaches from parisboy's thread Analysis and Trading based on Envelopes, Waves, Cycles.

The charts below are my attempt at a simple model for use in trading NQ. It's based on Hull Moving Average Keltner channels. Why HMA? Because it's a linear predictor of the WMA of half its period length.

Happy to share details should anyone be interested. These are 15m charts.

1