hello guys

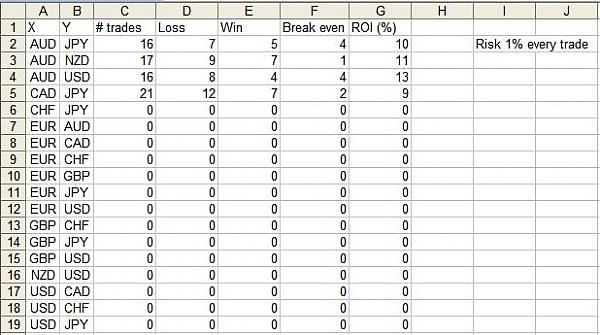

Yesterday when i was looking at the charts, i found something interesting about price action. The approach is like trial-and-error method to catch a trend. So i spent the whole day backtesting it for the last year only. According the test results, the number of winning trades (break even trades included) is more or less the same as that of losing trades, especially 9-12 for cad/jpy. However, the ROI is quite good, roughly 10% for each pair if i risk only 1% every trade. This sounds like too good to be true, at least for me. So i decided to forward test it and keep the results here.

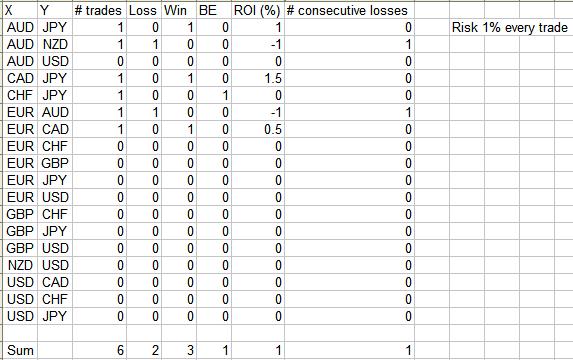

In this experiment, the risk for every trade is always 2%.

Ok, here are the trades for today:

#01 Short AUD/JPY at 94.05, SL 94.67

#02 Short EUR/JPY at 157.14, SL 158.06

#03 Short EUR/CHF at 1.6224, SL 1.6266

Pending orders:

Short CAD/JPY at 102.92, SL 103.53

Short EUR/AUD at 1.6747, SL 1.6815

Long EUR/CAD at 1.5255, SL 1.5174

Short GBP/USD at 1.9574, SL 1.9674

Yesterday when i was looking at the charts, i found something interesting about price action. The approach is like trial-and-error method to catch a trend. So i spent the whole day backtesting it for the last year only. According the test results, the number of winning trades (break even trades included) is more or less the same as that of losing trades, especially 9-12 for cad/jpy. However, the ROI is quite good, roughly 10% for each pair if i risk only 1% every trade. This sounds like too good to be true, at least for me. So i decided to forward test it and keep the results here.

In this experiment, the risk for every trade is always 2%.

Ok, here are the trades for today:

#01 Short AUD/JPY at 94.05, SL 94.67

#02 Short EUR/JPY at 157.14, SL 158.06

#03 Short EUR/CHF at 1.6224, SL 1.6266

Pending orders:

Short CAD/JPY at 102.92, SL 103.53

Short EUR/AUD at 1.6747, SL 1.6815

Long EUR/CAD at 1.5255, SL 1.5174

Short GBP/USD at 1.9574, SL 1.9674

Attached Image