This might be a silly question, but reading Vegas' Method, he talks about the "outer edge of the fib lines".

??

My familiarity with the fib lines (fib retracements) is that I pick the high point, and the low point, and use my little tool, and it will draw out the fib retracement lines for me.

Is this what Vegas is talking about? Because one of the problems I have with the Fib lines, is usually, which bar do I select as my "bar in which I begin my fib?" (pun intended). What price point is my "0" so I can measure if the current price is on the outer edges??

He also talks about taking profit in fig number sets; like 144 etc.. Does he mean, when I'm up 144 pips, if I am in for 3 units, I close 1 of the units, etc?

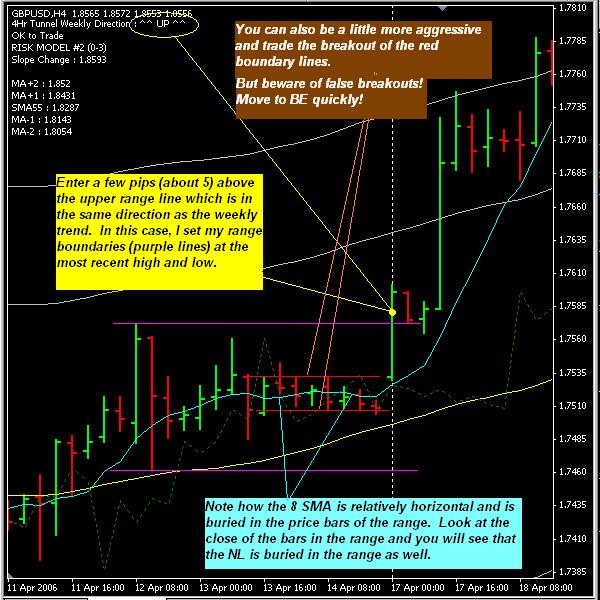

Hope someone can help me clear up the confusion with a sample chart!

Thanks everybody, new here, but great forum.

??

My familiarity with the fib lines (fib retracements) is that I pick the high point, and the low point, and use my little tool, and it will draw out the fib retracement lines for me.

Is this what Vegas is talking about? Because one of the problems I have with the Fib lines, is usually, which bar do I select as my "bar in which I begin my fib?" (pun intended). What price point is my "0" so I can measure if the current price is on the outer edges??

He also talks about taking profit in fig number sets; like 144 etc.. Does he mean, when I'm up 144 pips, if I am in for 3 units, I close 1 of the units, etc?

Hope someone can help me clear up the confusion with a sample chart!

Thanks everybody, new here, but great forum.

google: