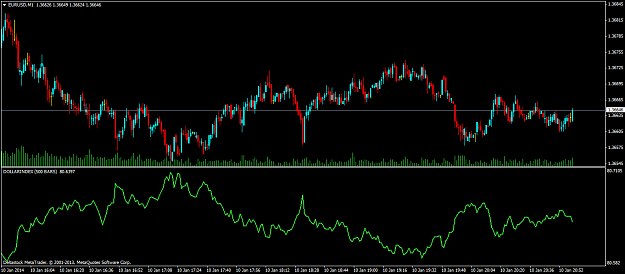

I saw many people talking about correlations and how powerful they are, so since the EUR/USD is the most popular pair traded, the Dollar index is probably the most correlated with the EUR/USD.

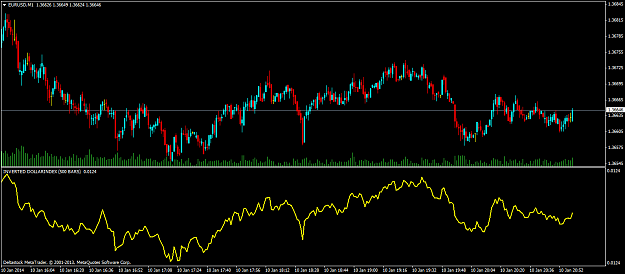

The Dollar Index, is almost exactly the reverse function of the EUR/USD movement, so what i did is i made an indicator which shows you the Dollar index, but since the USDX is the inverse of the EUR/USD, i just inverted it, so now it shows the EUR/USD very well.

Now my question to correlation traders is:

The Dollar Index, is almost exactly the reverse function of the EUR/USD movement, so what i did is i made an indicator which shows you the Dollar index, but since the USDX is the inverse of the EUR/USD, i just inverted it, so now it shows the EUR/USD very well.

Now my question to correlation traders is:

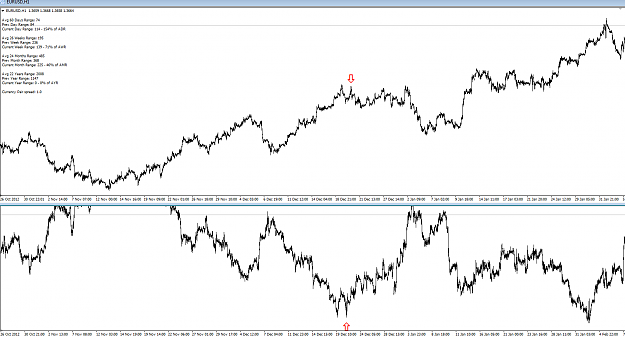

- How can you take advantage of this? How can you predict the EUR/USD to have atleast a slightly edge by using the Dollar Index?

- Is divergence trading possible here?

- Other observations

So if anyone among you are using currency correlations , and are expert in them, i would like you to discuss how would you use the USDX in predicting the EUR/USD?

-------------------

Here is my own made Dollar Index indicator:

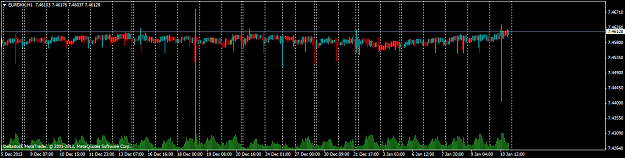

Attached File(s)

Attached File(s)

"There's a sucker born every minute" - P.T. Barnum