HOLA!

Using a simple, non-complicated approach for 20 pips on each trade.

RISK - 20PIPS / REWARD -> 20PIPS

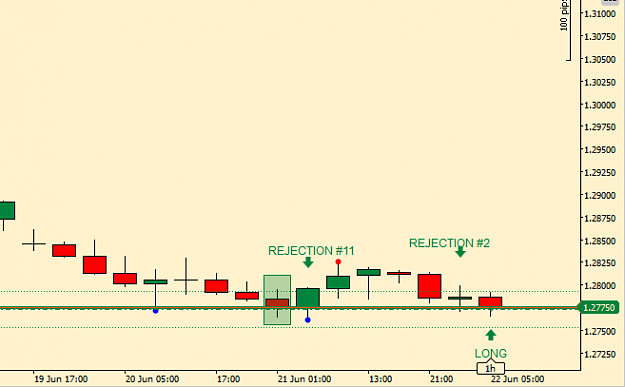

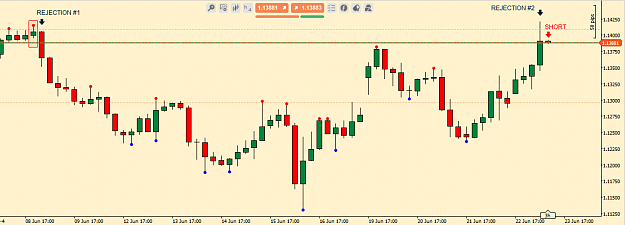

THE REJECTION TRADE

1. IF THE CLOSE PRICE OF A BEARISH BODY BAR IS REJECTED TWICE BUY

2. IF THE CLOSE PRICE OF A BULLISH BODY BAR IS REJECTED TWICE SELL

3. ENTER AS CLOSE AS POSSIBLE TO THE REJECTED CLOSE PRICE

4. BREAKEVEN TRADE ONCE UP 13PIPS

5. 4-HOUR CHARTS ONLY! (GOOD ALSO ON DAILY BUT RISK HIGHER 30-45PIPS)

6. IF WICKS OF REJECTION BARS ARE MORE THAN 12PIPS FROM THE CLOSE PRICE DOUBLE THE STOP & THE LIMIT.

HIGHER PROBABILITY

THE WIN PROBABILITY IS HIGHER WHENEVER THE REJECTION BARS CLOSE IN FAVOR OF THE POTENTIAL SETUP.

FOR EXAMPLE, IF A BEARISH BAR'S CLOSE PRICE IS REJECTED TWICE, AND THE REJECTION BARS BOTH CLOSE WITH A BULLISH BODY, THEN THE LIKELIHOOD OF A STRONG SUCCESSFUL TRADE INCREASES. THIS ALSO MEANS THE REWARD IS LIKELY TO INCREASE (MORE THAN 20 PIPS).

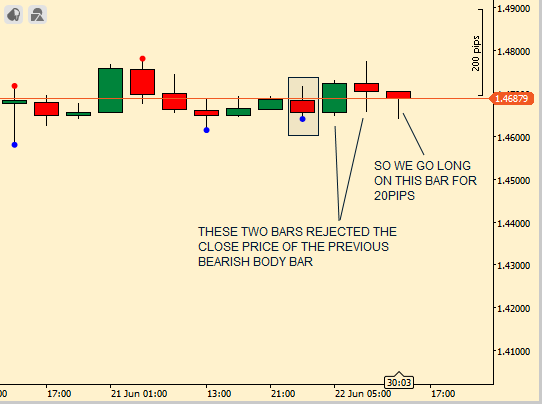

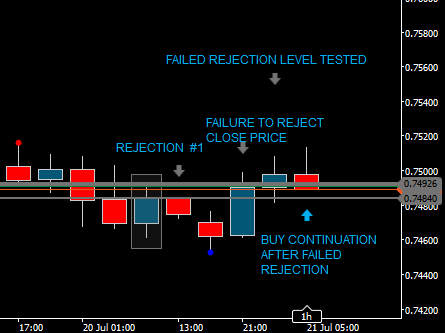

THE CONTINUATION TRADE

A continuation setup occurs when rejection fails OR the rejection level is soon converted to a continuation level. Essentially, one or more bars, usually one, rejects a close price, then there is a close beyond the close price of the REJECTED BAR. This suggests a continuation in the trend of the BAR WITH CLOSE BEING TESTED. See attached example.

1. IF THE CLOSE PRICE OF A BEARISH BODY BAR IS REJECTED, AND SUBSEQUENTLY PRICE CLOSES BELOW THE CLOSE PRICE OF THE BAR SELL

2. IF THE CLOSE PRICE OF A BULLISH BODY BAR IS REJECTED, AND SUBSEQUENTLY PRICE CLOSES ABOVE THE CLOSE PRICE OF THE BAR BUY

3. STOP SHOULD BE 6 PIPS ABOVE/BELOW THE BAR WHICH CLOSED BEYOND THE CLOSE PRICE OF THE BAR BEING TESTED

3. LIMIT SHOULD BE 2 TIMES THE RANGE (HIGH-LOW) OF THE BAR WHICH CLOSED BEYOND THE CLOSE PRICE OF THE BAR BEING TESTED

SIGNIFICANCE OF FRACTALS

When a setup occurs on a bar in the fractal structure it tells me its a potential swing trade. Therefore these setups are stronger.

IMPORTANT: TIMING IS KEY! TWO TRADERS CAN TAKE THE SAME TRADE AND GET DIFFERENT RESULTS DUE TO TIMING OF ENTRY. WE WANT TO ENTER THE TRADE ON THE VERY FIRST RETURN TO THE REJECTED AREA.

THAT'S IT!

Let's trade it!

Using a simple, non-complicated approach for 20 pips on each trade.

RISK - 20PIPS / REWARD -> 20PIPS

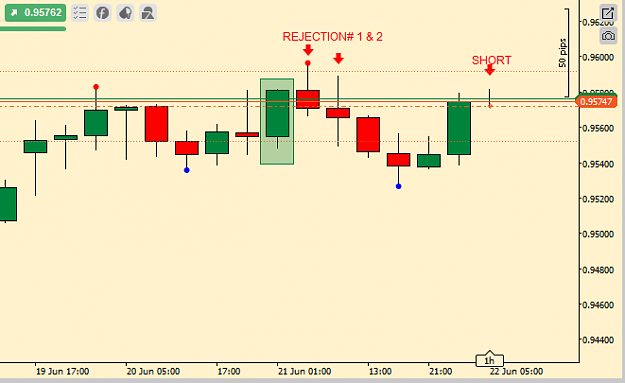

THE REJECTION TRADE

1. IF THE CLOSE PRICE OF A BEARISH BODY BAR IS REJECTED TWICE BUY

2. IF THE CLOSE PRICE OF A BULLISH BODY BAR IS REJECTED TWICE SELL

3. ENTER AS CLOSE AS POSSIBLE TO THE REJECTED CLOSE PRICE

4. BREAKEVEN TRADE ONCE UP 13PIPS

5. 4-HOUR CHARTS ONLY! (GOOD ALSO ON DAILY BUT RISK HIGHER 30-45PIPS)

6. IF WICKS OF REJECTION BARS ARE MORE THAN 12PIPS FROM THE CLOSE PRICE DOUBLE THE STOP & THE LIMIT.

HIGHER PROBABILITY

THE WIN PROBABILITY IS HIGHER WHENEVER THE REJECTION BARS CLOSE IN FAVOR OF THE POTENTIAL SETUP.

FOR EXAMPLE, IF A BEARISH BAR'S CLOSE PRICE IS REJECTED TWICE, AND THE REJECTION BARS BOTH CLOSE WITH A BULLISH BODY, THEN THE LIKELIHOOD OF A STRONG SUCCESSFUL TRADE INCREASES. THIS ALSO MEANS THE REWARD IS LIKELY TO INCREASE (MORE THAN 20 PIPS).

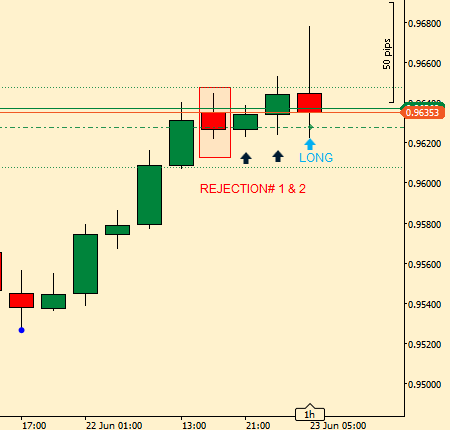

THE CONTINUATION TRADE

A continuation setup occurs when rejection fails OR the rejection level is soon converted to a continuation level. Essentially, one or more bars, usually one, rejects a close price, then there is a close beyond the close price of the REJECTED BAR. This suggests a continuation in the trend of the BAR WITH CLOSE BEING TESTED. See attached example.

1. IF THE CLOSE PRICE OF A BEARISH BODY BAR IS REJECTED, AND SUBSEQUENTLY PRICE CLOSES BELOW THE CLOSE PRICE OF THE BAR SELL

2. IF THE CLOSE PRICE OF A BULLISH BODY BAR IS REJECTED, AND SUBSEQUENTLY PRICE CLOSES ABOVE THE CLOSE PRICE OF THE BAR BUY

3. STOP SHOULD BE 6 PIPS ABOVE/BELOW THE BAR WHICH CLOSED BEYOND THE CLOSE PRICE OF THE BAR BEING TESTED

3. LIMIT SHOULD BE 2 TIMES THE RANGE (HIGH-LOW) OF THE BAR WHICH CLOSED BEYOND THE CLOSE PRICE OF THE BAR BEING TESTED

SIGNIFICANCE OF FRACTALS

When a setup occurs on a bar in the fractal structure it tells me its a potential swing trade. Therefore these setups are stronger.

IMPORTANT: TIMING IS KEY! TWO TRADERS CAN TAKE THE SAME TRADE AND GET DIFFERENT RESULTS DUE TO TIMING OF ENTRY. WE WANT TO ENTER THE TRADE ON THE VERY FIRST RETURN TO THE REJECTED AREA.

THAT'S IT!

Let's trade it!

Attached Image

Time it carefully, Plan it thoroughly, Trade it confidently!